Here’s an opinion piece on How come the impressive growth of gold loans during the pandemic still falls short of the potential support they could have given to the masses and what can we do to access the full potential of gold loans.

As life rolls back to normalcy post-pandemic, it is the right time to assess our policy response and learn to prepare ourselves if such an event happens to repeat in the future. In this opinion piece, I am going to focus on one particular credit category – Gold loans.

Global response to the pandemic – Cheaper and easier credit

In 2020, as the pandemic started income destruction due to lockdowns, governments across the globe sprung into action through a combination of monetary, fiscal, and policy actions. Massive relief packages were announced which took different forms including direct income transfers, tax rebates, accommodative monetary policies, and special sectoral schemes.

Banks focussed on ensuring adequate liquidity and protecting the solvency of the vulnerable indebted consumers and businesses. At the peak of the pandemic, Banks launched a slew of measures such as interest moratoriums, interest reliefs, special credit support, and liquidity gap funding.

Gold prices and Gold loans both outperformed during the market uncertainties

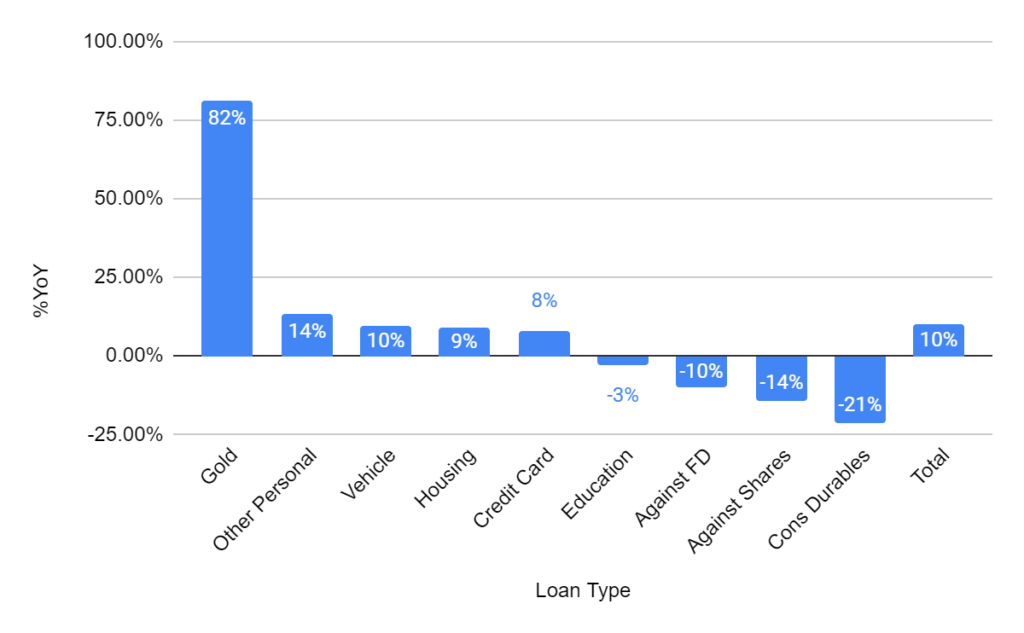

In order to avoid a sudden risk aversion and a subsequent liquidity/credit crunch in the market, the regulators poured in easy credit and even though credit growth tapered, the policy support helped avoid an absolute catastrophe. As a result, in India, even though we saw a tapered overall personal credit growth of just ~10% (vs. ~15% in FY20), gold loans outperformed spectacularly at 82% (Refer Chart 1) growth YoY due to the following factors at play:

Factor 1: The surge in the gold price and the accompanying wealth effect

At the peak of the pandemic, the gold price rose to Rs 5000+/gram from Rs ~3000/gram at the start of 2020. This created a massive wealth effect (in a period of weak sentiment) of USD 89bn (Refer Table 1) or Rs. 6,67,170 Crores in the ~300mn+ Indian households (HH) each of whom roughly held 20 grams of gold on average according to the AIDIS survey 2019.

Table 1: The wealth effect of gold price movement during the pandemic and potential credit opportunity

| Event | Date | Gold Price | HH Wealth in Gold | Potential Credit @75% LTV | Potential incremental credit |

|---|---|---|---|---|---|

| Rs/Gram | USD bn | USD bn | USD bn | ||

| As on Survey Date* | 30-Jun-2018 | ₹3,098 | 250 | 188 | – |

| As on Pandemic Start** | 31-Dec-2019 | ₹3,814 | 308 | 231 | – |

| As on Pandemic Peak** | 4-Sep-2021 | ₹5,281 | 427 | 320 | 89 |

| As on Today** | 15-Oct-2021 | ₹4,678 | 378 | 284 | 52 |

Factor 2: Increase in the Gold Loan LTV to 90% from 75%

Another big development during the pandemic was the temporary increase in the Loan-to-value (LTV) ratio for gold loans to 90% from 75%. This was allowed by the RBI in order to tide over the difficulties in repayments. This allowed more borrowing against the existing collateral and further supported an increase in the gold prices.

Factor 3: Bank focus on Gold loans

The Banks also focussed on the gold loans as many other risky retail credit products such as lending for consumer durables saw a dip. Many Banks increased the coverage of their gold loan offering across multiple branches. This availability coupled with the increase in the need for credit due to stress during the pandemic further supported the growth in gold loans.

Chart 1: Increase in disbursements (%YoY) of various personal loan sub-categories for SCBs

However, we could have done better

This impressive performance of the gold loans, however, resulted in a net additional credit flow of only Rs. 27,161 Crores in FY21 from the Scheduled Commercial Banks (SCBs) according to RBI data. This falls significantly short of the potential USD89bn or Rs. 6,67,000 Crores of additional credit which could have been possible (at 75% LTV – Refer Table – 1) just on the back of an increase in the gold prices during the Pandemic. These numbers look massive and unrealistic but even at 15% of the monetization of existing gold through loans, a credit offtake of Rs 1,00,000 Crores could have been possible. This potential additional credit may have very well played a part in countering the tapering credit offtake seen by the MSME sector at a mere 0.5%YoY growth during the same period without impacting the asset quality.

Factors holding back the growth of gold loans include:

- Weak consumer sentiment – Sentiment of economic weakness which led to a focus on saving and deleveraging during the times of economic uncertainties

- Social stigma – Stigma around liquidating gold due to the view that it is the insurance of the last resort

- Hassle – Inconvenience related to taking gold loans due lack of adequate infrastructure

Gold loans are a truly “Made in India” credit product that came to the rescue of distressed borrowers during the pandemic. This again emphasized the counter-cyclical nature of gold prices. More importantly, it also highlighted the increased Bank appetite for gold loans and improved customer awareness of the benefits of the gold loan product. This is a very good starting point for a larger credit revolution around the monetization of the idle gold lying in the household lockers in India and the lenders as well as policymakers should not overlook the opportunity that the pandemic has presented.

What could be the action plan to unlock the power of India’s idle gold?

- Priority sector status for gold loans below a particular threshold (say Rs. 3 lakhs)

- Correction of regulatory arbitrage between Banks, NBFCs, Co-operatives and SFB Gold loans on LTV, Bullet loans, etc.

- Promotion of new and innovative models (Currently Gold loan not included in co-lending, P2P scope)

- Allow innovation in the product with liberalisation in the LTV norms and proper disclosures for borrower awareness and safety

- Setting up of gold loan targets just like agri/PSL credit targets to send a clear signal of policy focus on the gold loans

- Asking the Banks to chart out a longer term gold loan policy to create massive gold loan infrastructure

- Regulatory framework for gold loans against dematerialised gold loans

- Introducing gold loans as a theme in the RBI’s next sandbox cohort

- Government/PSB funded awareness campaign on gold loans on the lines “Mutual Funds Sahi Hai…” campaign