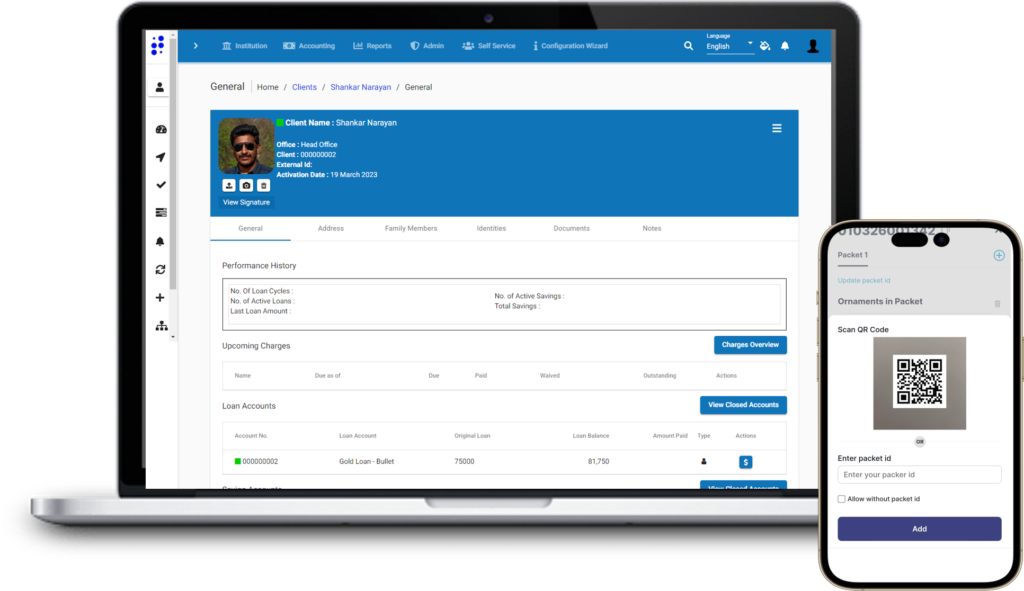

Complete Gold Loan Management System

GLIMS is built ground-up specifically for gold loans and not a make-shift customization of a personal loan LMS

Key Features of GLIMS

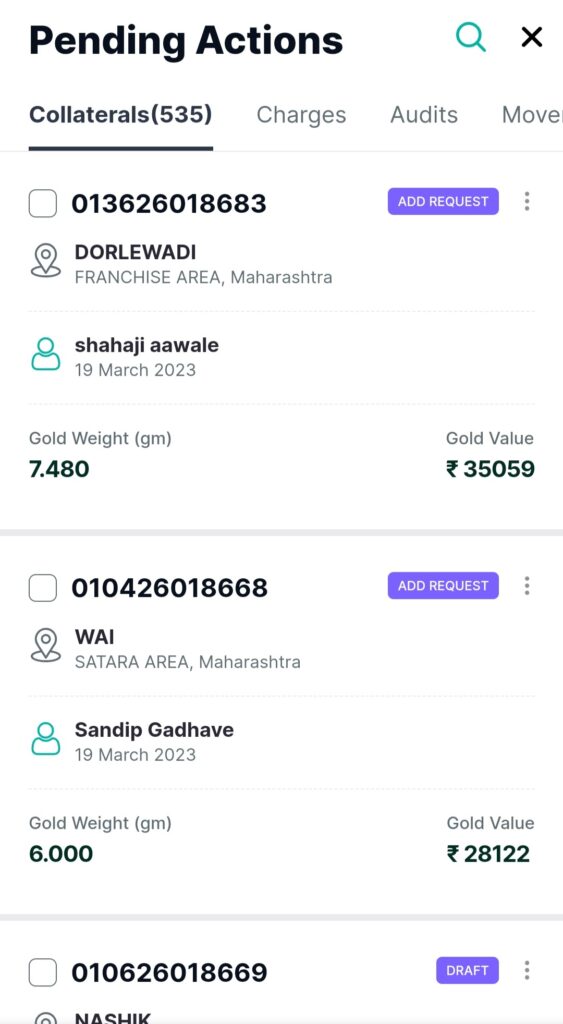

Collateral Management

Comprehensive tracking of ornament types, images, damages, purity and weight details

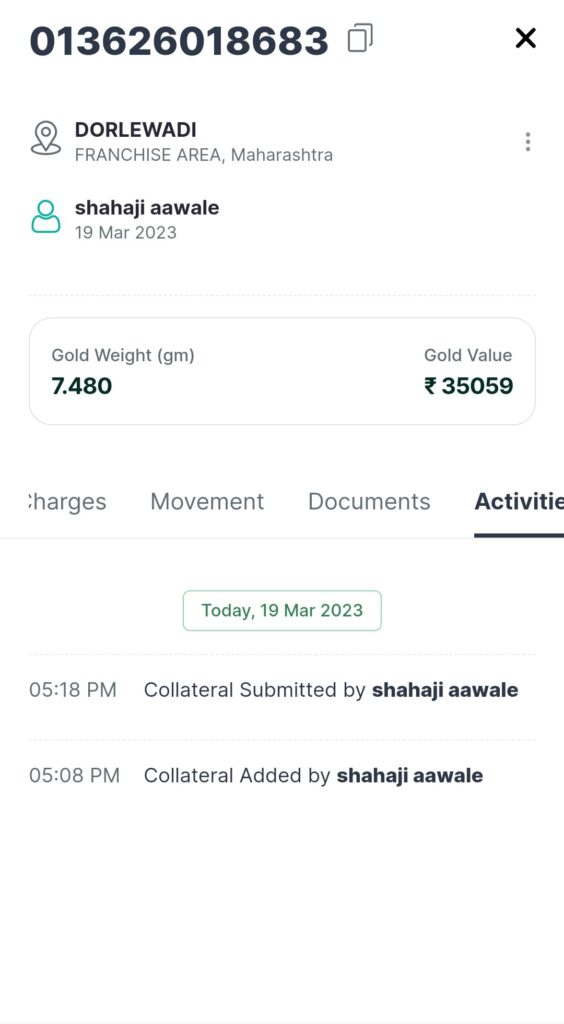

Audit Management

Appraisal and audit solution that lets you carry out multiple comprehensive gold valuations of each ornament

Loan Management

Loan management with a wide range of products including bullet-repayment and rebate-based products

Comprehensive Reporting

Comprehensive risk reporting with customizable reports as per your needs and regular monitoring

Cloud First

State-of-the-art security and cloud-first solution to allow easy-scaling and use-based usage

Extensible

Completely modular solution with REST API to integrate and extend GLIMS with your own software stack

Maker-checker system

Customizable maker-checker system allows you to configure maker-checker workflows based on role hierarchy, loan amounts and other configurable parameters

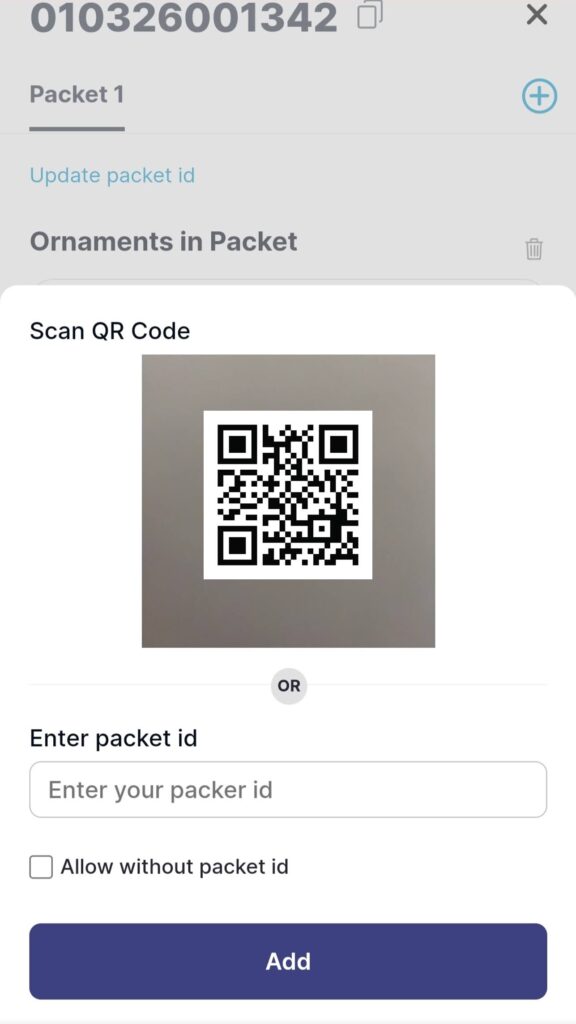

QR Code enabled

QR code based system allows you to keep track of all the collateral which reduces the time to carry out gold loan inward and outward operations error-free and efficiently

Complete Activity Logs

Track every activity including inward, outward, movement and approval logs on a real-time which allows you to prevent frauds and keep complete control on your collateral

⭐️⭐️⭐️⭐️⭐️

GLIMS is the most cost-effective and easy-to-use solution which we selected after rejecting at least 15 popular systems in the market.

Maharashtra based NBFC

⭐️⭐️⭐️⭐️⭐️

What I like about GLIMS is that it is specifically built for gold loans in mind which allows very efficient operations and best-in-class customer experience.

Maharashtra based co-operative Bank

⭐️⭐️⭐️⭐️⭐️

We do not have any in-house tech team but are still able to scale our operations using GLIMS due to very supportive tech and onboarding teams of Technovative.

Maharashtra based NBFC

Ready to get started?

GLIMS allows you to get started in as little as 30-days.

Copyright [year] Technovative Digital. All rights reserved.